Start saving money today! Money Saving Tips Budgeting and Paying Debt is the number one consideration to saving money. Let’s explore a variety of ways to save money. From standard traditional ways to innovative ways you probably haven’t heard of doing.

First Lessons

The very first lesson I learned about money was how to put my money in a piggy bank. This was a savings container of some shape, usually porcelain with a rubber stopper on the bottom. The money was held in the container, but you could get it out without breaking the porcelain. And…hence the name piggy bank, these were commonly shaped as a big round pig.

From there, my mom took me to the bank and we opened a savings account. I could make deposits as often as I wanted. However, a withdrawal took a parent signature. But here is where I deposited the checks I received for babysitting. I tended to keep the cash in a spot in my room to spend freely. By freely, I mean mostly on candy.

So those are the most traditional ways I think of when I think about saving money. Of course, as adults we have options such as 401k and stock investments but there are a ton of ways to save money between a savings account and investments. So, let’s begin our exploration of these ways.

Money Saving Tips Budgeting

People have various budgeting styles. You can budget by starting with your monthly bills and work from that aspect. In other words, the bills require this much money, then apply the rest of the money for all your other needs.

Or you can start with your monthly take home income and work your budget from your income. When monthly incomes vary, you can break down to budgeting from paycheck to paycheck. Unfortunately, there are millions of families budgeting in this manner and it is the least effective way to budget. However, it is a budgeting style.

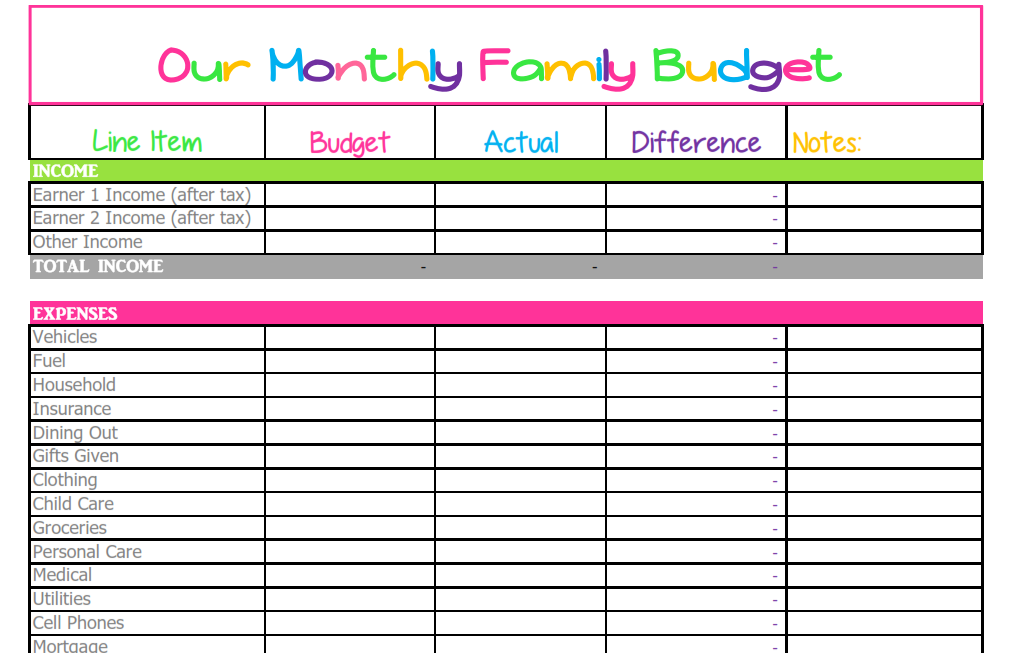

The number one and vital key to making a money savings tips budget is getting it all down on paper. Or today, on an e-file. But the point is putting your budget in a visual tool. Begin with listing all your living expenses. This includes house payment, rent, homeowner’s insurance, property tax, renter’s insurance, utilities such as electric, gas, sewer, water and trash. Then, list your creditors. Your creditors will include your auto loans, educations loans, medical insurance and bills, credit card debt, and anyone else that sends you a monthly bill with interest attached.

Budgeting for Beyond the Basics

Here’s where the other things in life come in. The incidentals and the unexpected expenses. With kids, there are school field trips, school lunches, school pictures. After school activities. Sports, dance, science clubs, band, orchestra or choir. Your child may be involved in multiple activities. Plus, your school needs support for the Parent Teacher Organization (PTO) which helps support school activities. If you are a parent, you understand clearly you ARE the biggest source of all your child’s fundraising activities. Only grandma and grandpa can compare to your support.

Next on your budget, clothing, shoes, haircuts and allowances. Yes, with children, you need to budget for any allowances you offer. Don’t forget all the gifts and treats for year around too! Birthdays, Christmas, Easter. Be prepared too for last minute shopping for gifts your son or daughter can take to the birthday party they were invited to at the last minute.

And while not everyone practices gift exchanges for all the holidays, it is to be highly expected your spending will increase around any holiday. This could be in the form of travel expenses, additional groceries for a family gathering or friends outing. Decorations and holiday appropriate treats for the family.

Advanced Budgeting

Budgets should also include pets and pet-related expenses, including veterinarian expenses. Obviously, this is pet food. But depending on your pet, this can be a big part of your budget.

What about budgeting for your kids’ college? Your retirement? A new car? A bigger house? A travel trailer? A boat? How about the ATV’s? As you can see, these are all things that cost money.

Instead of buying a new house, choose to remodel. That will reduce your investment of money at this stage of the game but a remodel gets costly too.

Pay Down Current Debt

Consolidate Your Debt – You will find credit card companies frequently offer promotions for you to transfer your debt to their card with a small transfer fee but no interest period. This has potential to be a wise solution to pay off debt while reducing the interest at the same time. However, you need to have semi-healthy and stable credit rating to accomplish this because the offering company still does a credit check on you which hits your credit rating. Their final offer is still pending your credit score as is the final interest rate. The offer you have received could be contingent on the fine print!

Another widely accepted tip is to pay your bills off methodically. Beginning with the bill that has the least amount owed. When you wipe out that balance, then you take the money you paid monthly for that debt and roll it into the total amount you pay for the next least amount owed.

Debt Goes Down, Credit Score Goes Up

Continue to do this and you are opening each line of credit as the debt is paid. Your debt to allowable limit improves, your credit score improves. And as you go through this cycle, for each debt you pay, you increase the payment on the next one. This shows the payment is above minimum wage, reducing total amount for interest over time.

The above method is my approach. Partially because I can track where my money was spent and how long it has taken me to pay off each debt. But when a balance is finally paid in full, it feels great! Financial burden is not just a weight on your pocket book, it does weigh on your shoulders. It’s stress!

Likewise, the thought is by consolidating your debt under one line of credit, then the payment is lowered. Therefore, releasing you from multiple bills with minimum payments at high interest. This step tends to improve your credit score. Plus, when you can make extra payments above minimum, it really makes you shine.

Do not ADD to your current debt, use cash only for your purchases above and beyond your budget. Whether this means denying yourself of your wants or saving cash on the side for your wants – a goal jar. You have a third option of putting it on a gift list with hopes someone else will gift your wants to you.

Money Saving Tips NEXT Articles:

Around the Household, Utility and Transportation #2

Sales Save Money Outside the Home #3

Other Related Articles

If you have enjoyed reading any of these articles, please register your name and email address for new articles and other updates from my website, Madhatter’s Magnificent Market.

Visit all our categories and pages of Madhatter’s Magnificent Market!

Return to the HOME PAGE to decide which category to shop next!